Double-Entry Accounting: The Complete Guide for Modern Businesses

Double-entry accounting stands as the cornerstone of modern financial record-keeping, serving businesses for over 500 years. In this comprehensive guide, we'll explore how this essential system works and why it's crucial for your business success. Try our accounting software to implement these principles effortlessly.

What is Double-Entry Accounting?

Double-entry accounting is a bookkeeping method that records each financial transaction in at least two different accounts, ensuring that debits always equal credits. This system provides a complete picture of your business's financial health and helps prevent errors in your books.

Key Principles:

- Every transaction affects at least two accounts

- Total debits must equal total credits

- Each account has two sides: debit and credit

- Assets = Liabilities + Equity

The Five Main Account Types

Double-entry accounting organizes all transactions into five main categories:

- Assets: Resources owned by the business

- Liabilities: Debts and obligations

- Equity: Owner's stake in the business

- Revenue: Income from business activities

- Expenses: Costs incurred in operations

Our platform automatically categorizes transactions into these accounts, saving you valuable time.

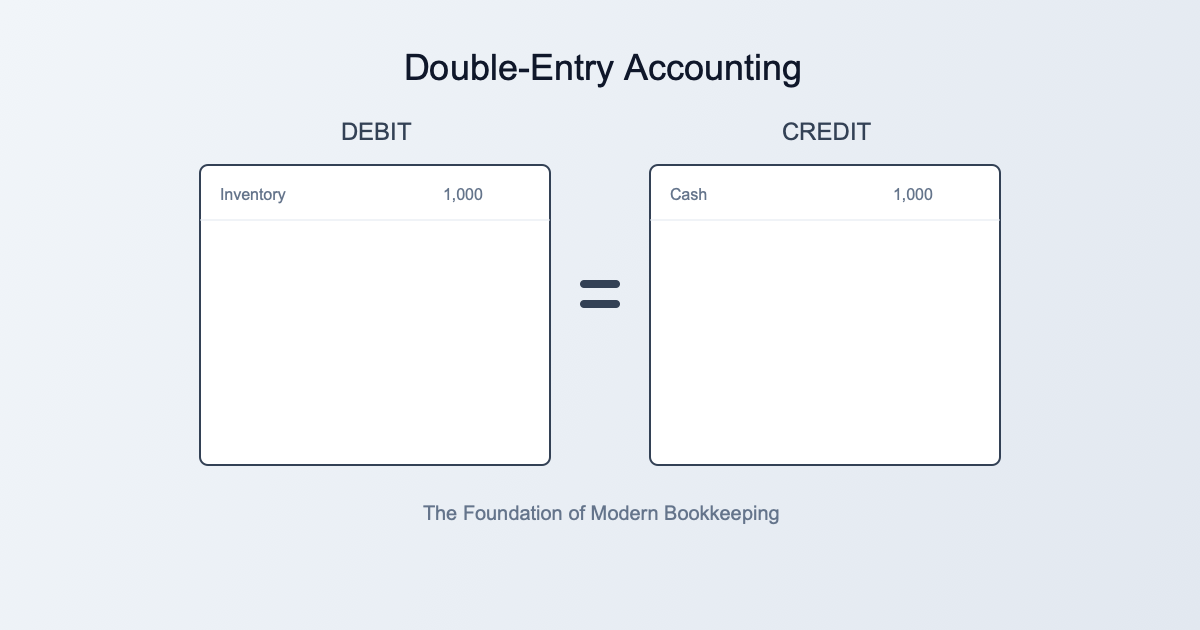

Practical Example of Double-Entry Accounting

Let's examine a common business transaction:

When you purchase $1,000 worth of inventory with cash:

- Debit Inventory (Asset) : $1,000

- Credit Cash (Asset) : $1,000

This maintains the balance while accurately reflecting the movement of resources.

Benefits of Double-Entry Accounting

- Error Detection: The system's built-in checks help identify mistakes quickly

- Complete Financial Picture: See both sides of every transaction

- Better Decision Making: Access comprehensive financial data

- Audit Readiness: Maintain detailed records for compliance

Start your free trial today to experience these benefits firsthand.

Modern Double-Entry Accounting Software

Traditional manual double-entry bookkeeping was time-consuming and error-prone. Modern accounting software has revolutionized this process by:

- Automating entry validation

- Generating real-time reports

- Providing audit trails

- Enabling cloud-based collaboration

Our cloud-based solution handles these complexities while maintaining the accuracy of double-entry principles.

Best Practices for Double-Entry Accounting

- Regular Reconciliation: Check accounts frequently

- Documentation: Maintain supporting documents for all entries

- Chart of Accounts: Organize accounts logically

- Regular Backups: Protect your financial data

- Professional Review: Periodic expert oversight

Getting Started with Double-Entry Accounting

- Set up your chart of accounts

- Choose reliable accounting software

- Establish opening balances

- Create standard procedures

- Train relevant staff

Contact our team for personalized guidance on implementing double-entry accounting in your business.

Advanced Topics in Double-Entry Accounting

Accrual vs. Cash Basis

Understanding when to record transactions affects your books significantly. Accrual accounting records transactions when they're incurred, while cash basis records them when money changes hands.

Adjusting Entries

These special entries ensure your books accurately reflect your financial position at period end. Common adjusting entries include:

- Depreciation

- Prepaid expenses

- Accrued revenues

- Unearned revenues

Conclusion

Double-entry accounting provides the foundation for accurate financial reporting and business decision-making. While the concepts may seem complex, modern tools make implementation straightforward. Try our solution to modernize your accounting practices and maintain accurate financial records effortlessly.

Ready to streamline your accounting process? Sign up now and join thousands of businesses already benefiting from our powerful accounting platform.